The Lithium Bottleneck: How Supply Constraints Are Reshaping Energy Storage

As the global energy transition accelerates, lithium-ion batteries have become the cornerstone of both electric mobility and stationary energy storage. Yet, this massive growth in demand has brought a critical issue into sharp focus: the lithium bottleneck. With limited extraction capacity, long development timelines for new mines, and geopolitical concentration of supply, the availability of lithium is emerging as a defining constraint on the pace and scalability of clean energy infrastructure.

Why Lithium Matters for Energy Storage

Lithium-ion batteries are prized for their high energy density, long cycle life, and relatively low self-discharge rates. These properties make them essential for electric vehicles (EVs), but they are also increasingly deployed in grid-scale energy storage systems (ESS), where they help balance intermittent renewables like wind and solar.

According to BloombergNEF, demand for lithium for stationary storage is projected to grow over 20-fold by 2030, a pace that competes directly with EV growth for limited lithium resources1. This convergence is stressing a supply chain that was never designed to scale so rapidly.

The Nature of the Bottleneck

The lithium supply chain is complex. The majority of the world’s lithium is extracted from hard rock mines in Australia and brine fields in Chile, Argentina, and Bolivia. From there, it must go through several refining stages to produce battery-grade lithium hydroxide or carbonate.

- Geopolitical risk: Over 50% of lithium refining capacity is concentrated in China, raising concerns about supply stability and trade policy impacts2.

- Long lead times: New lithium projects can take 7–10 years to move from exploration to production, making the supply inelastic in the short term3.

- Environmental impact: Both brine and hard rock extraction carry significant environmental costs, including water usage and habitat disruption.

Implications for the Energy Storage Sector

Unlike EVs, which require compact, lightweight batteries, grid storage systems prioritize cost, lifespan, and thermal stability. However, most of today’s installations still rely on lithium chemistries (particularly LFP—lithium iron phosphate) due to falling prices and market familiarity.

With lithium prices spiking over 400% between 2021 and 2022 before stabilizing4, project developers are increasingly reconsidering their options. Supply constraints threaten not only pricing, but also project timelines and regional independence for national energy grids.

Long-duration storage—needed to buffer multi-day renewable variability—will require more cost-stable, scalable chemistries. The lithium supply squeeze has therefore become not just a pricing issue, but a strategic roadblock to the deployment of resilient, distributed energy systems.

Reade’s Role in Enabling Material Innovation for Energy Storage

At Reade, we work closely with clients developing next-generation energy storage systems by supplying high-purity raw materials and specialty additives tailored to evolving chemistries.

Our team supports innovation by:

- Supplying critical mineral compounds used in advanced batteries—such as

- Vanadium(V) Oxide (V₂O₅) for vanadium redox flow batteries,

- Niobium Oxides (Nb₂O₅, NbO₂, NbO) for emerging anode chemistries,

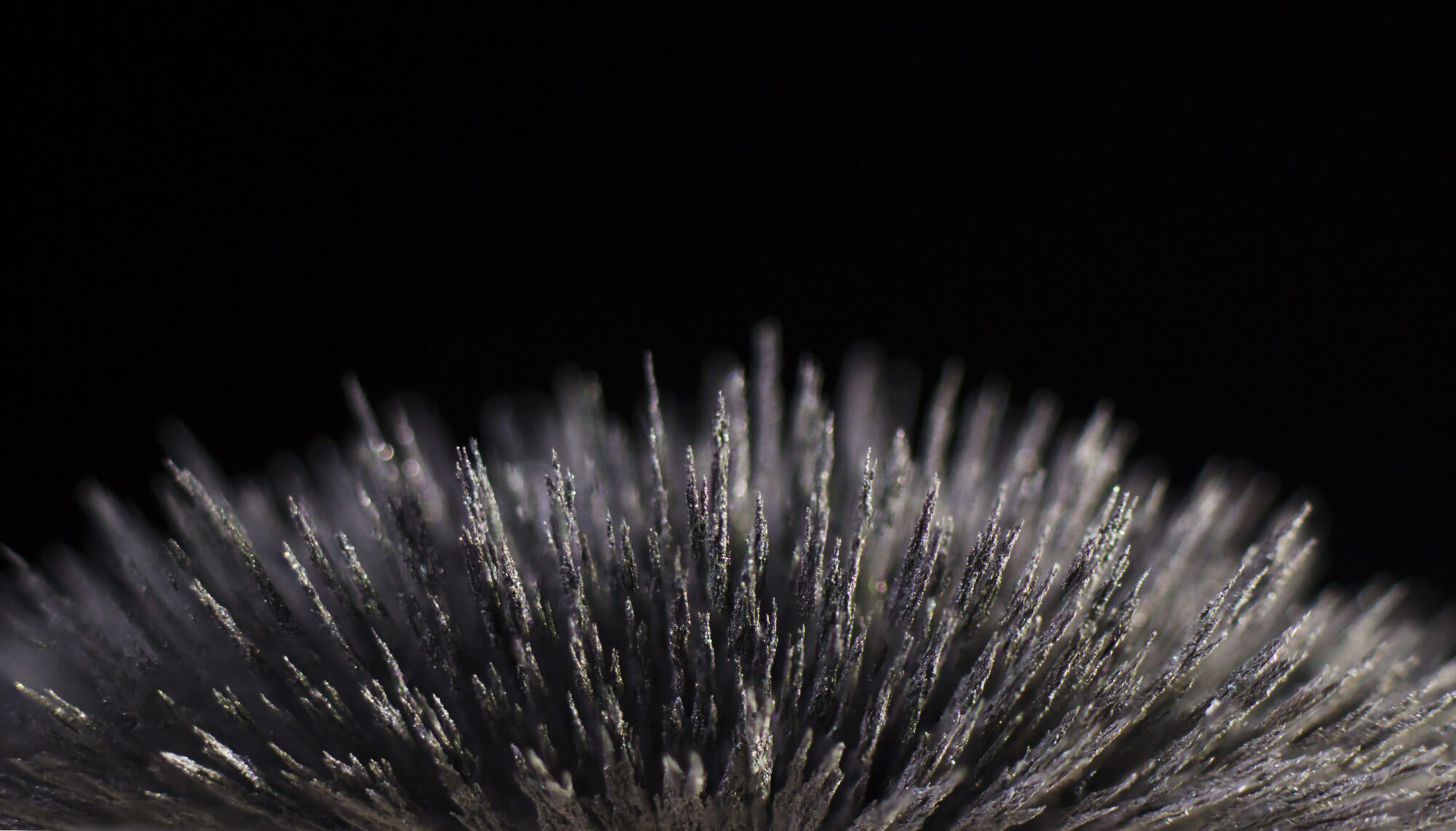

- Boron Amorphous (B) for energy storage additives and high-performance composites.

- Delivering custom particle sizing, purity grading, and engineered powders optimized for use in electrodes, separators, and electrolytes.

- Supporting thermal management solutions through materials like

- Silicon Carbide (SiC), known for its high thermal conductivity, and

- Carbon-Based Materials such as graphite for battery electrodes.

We recognize that the future of energy storage isn’t confined to a single chemistry. Whether our partners are designing LFP systems for grid-scale deployment or working on early-stage flow battery technologies, our expertise helps translate R&D into manufacturable reality.

The Road Ahead

To truly scale energy storage in a sustainable way, the industry must diversify both chemistry and sourcing strategies. While lithium will continue to dominate in the near term, the supply chain vulnerabilities it exposes should act as a catalyst for deeper investment in recycling, materials science, and alternative chemistries.

Governments and private industry alike are investing billions into securing domestic sources of critical minerals, but timelines remain long. In the interim, companies must rely on agile sourcing partners who understand both the technical requirements and commercial realities of energy storage at scale.

As pressure mounts to decarbonize the grid and support EV infrastructure, the lithium bottleneck is a pivotal challenge. But with smart planning and deeper material expertise, it’s one the industry can overcome.

References

- BloombergNEF. Battery Market Long-Term Outlook 2023. https://about.bnef.com

- International Energy Agency (IEA). Global Supply Chains of EV Batteries, 2022. https://www.iea.org/reports/global-supply-chains-of-ev-batteries

- U.S. Department of Energy. Lithium Supply Chain Review, 2021. https://www.energy.gov/policy/lithium-battery-supply-chain-review

- Benchmark Mineral Intelligence. Lithium Price Assessment, 2023. https://www.benchmarkminerals.com