Magnesium: A Critical Material with a Single Source Problem

Magnesium has always been a quiet workhorse of modern industry. Lightweight, strong, and highly versatile, it plays an essential role in automobiles, airplanes, electronics, and even the emerging clean energy economy. For decades, engineers have turned to magnesium alloys to shave weight off critical components, improve fuel efficiency, and deliver performance in environments where every gram matters. Yet despite its importance, magnesium has a supply chain problem that makes it unusually vulnerable. Almost all of the world’s primary magnesium comes from one country: China.

That concentration poses risks not just for manufacturers but for the entire downstream economy. Understanding why magnesium matters, why supply is so fragile, and what solutions are being explored is crucial for anyone watching global materials markets today.

Why Magnesium Matters

The value of magnesium lies in its balance of lightness and strength. It is the lightest structural metal available, about 75 percent lighter than steel and 33 percent lighter than aluminum. Automakers have relied on magnesium alloys for steering wheels, transmission cases, seat frames, and other parts that help reduce overall vehicle weight and improve fuel economy. In aerospace, magnesium offers stiffness-to-weight advantages in components where performance under stress is critical. And in consumer electronics, its ability to dissipate heat efficiently makes it a material of choice in laptops and mobile devices¹.

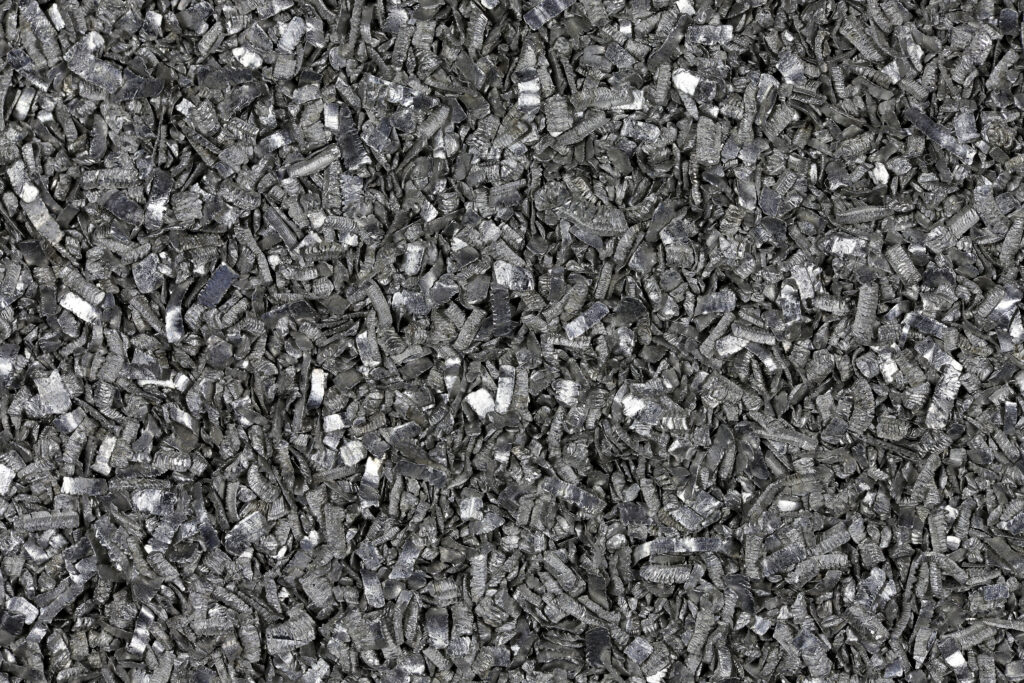

Magnesium also aligns with the sustainability goals of modern industry. Unlike many specialty materials, it is readily recyclable, and researchers are making progress in developing closed-loop recovery systems that can capture alloy scrap and reintroduce it into circulation². Emerging applications are pushing demand even further. From structural alloys for electric vehicles to potential roles in energy storage systems, magnesium’s relevance is expanding at precisely the moment when supply security is under question.

The Single Source Problem

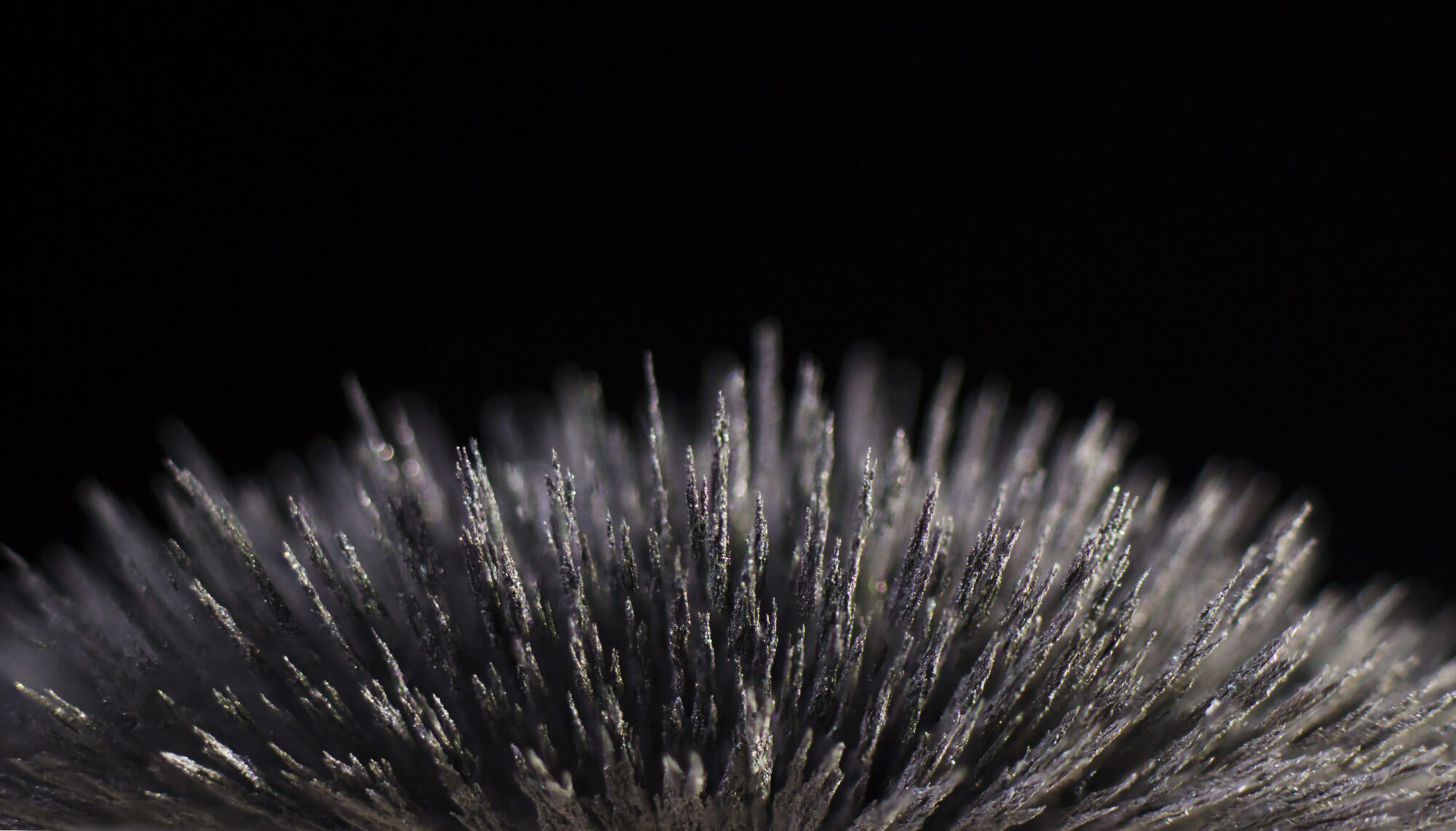

More than 85 percent of the world’s primary magnesium is produced in China, much of it concentrated in the provinces of Shaanxi and Shanxi³. The dominant technology used there, known as the Pidgeon process, is energy intensive and heavily reliant on coal. In recent years, Beijing has tightened environmental regulations, forcing plants to curtail production during periods of high pollution or when power supplies run short. These regulatory swings have created sudden shortfalls, leading to price spikes and severe volatility in global markets⁴.

This reliance on a single production base exposes manufacturers worldwide to risks that go far beyond commodity cycles. Energy costs, policy decisions, and even local infrastructure issues in one region of China now ripple outward to affect the availability of a metal essential to global industry. In 2021 and again in 2023, production cuts in Shaanxi province triggered widespread concerns across Europe and North America as buyers scrambled to secure material. The lesson was clear: without diversification, magnesium’s role in critical sectors will remain precarious.

Building Resilience in Supply

The industry has begun exploring ways to reduce its dependence on Chinese production, though alternatives remain limited. Several projects are underway in Europe, including efforts by Verde Magnesium in Romania, which is developing what could become the largest magnesium production facility outside China, with a planned annual capacity of 90,000 tonnes³. Similar initiatives in Bosnia-Herzegovina and Serbia highlight Europe’s determination to re-establish its domestic base.

North America and Australia are also considering new facilities, but cost structures are challenging. Chinese magnesium benefits from established infrastructure and comparatively low labor costs. Re-establishing production elsewhere requires large capital investments, long permitting timelines, and competitive energy pricing. Until those hurdles are cleared, China is likely to retain its position as the world’s supplier of last resort.

At the same time, recycling and secondary supply offer promising avenues. Research suggests that millions of tonnes of magnesium could be recovered annually from alloy scrap, aluminum finishing waste, and other industrial by-products². Recycling not only supplements primary supply but also reduces carbon emissions, a growing concern for manufacturers facing ESG reporting requirements.

Innovation in production processes is another front. Low-carbon smelting techniques, electrolytic methods, and even extraction from salt brines or seawater are being studied. These technologies remain at pilot or early commercial stages, but they represent long-term strategies to insulate global supply from single-country dominance¹.

What It Means for Industry

For industries that depend on magnesium, the implications are immediate. Automakers and aerospace companies are already factoring potential disruptions into their procurement strategies, often seeking long-term contracts or diversifying their supplier base where possible. Electronics firms face similar pressures, particularly as demand for lightweight, heat-resistant alloys grows in next-generation devices. Cost forecasting has become increasingly difficult, as sudden price movements complicate budgeting and project planning. And sustainability commitments are adding another layer of complexity, with buyers seeking sources that can demonstrate low-carbon or recycled content credentials.

The magnesium story is ultimately a supply chain story. It underscores how global industries can be built around a material that is abundant in the earth’s crust but scarce in production due to the concentration of refining capacity. It also highlights how environmental regulation, energy pricing, and geopolitical factors can converge to create vulnerabilities that no single company can solve on its own.

Looking Ahead

Magnesium demand is projected to grow steadily at 4 to 5 percent annually over the next decade, propelled by the twin forces of lightweighting and green technologies¹. Meeting that demand will require more than a single-source model. Recycling, innovation in production, and investment in new facilities outside China will all be necessary steps. For now, though, the magnesium market serves as a case study in both the promise and the peril of global materials reliance.

Until the world develops more diverse supply, magnesium will remain one of the most critical and fragile links in the modern industrial chain.

References

- Light Metal Age. Global Magnesium Market Supply, Demand, and Future Outlook.

- ScienceDirect. Global Magnesium Cycle: Prospects for Recycling.

- Argus Media. Rest of World Magnesium Capacity to Grow but China Supply Risks Remain.

- American Chemical Society. Magnesium Shortage and Industry Risks.